Reverse a Credit Memo (Write Off)

To reverse a credit memo:

-

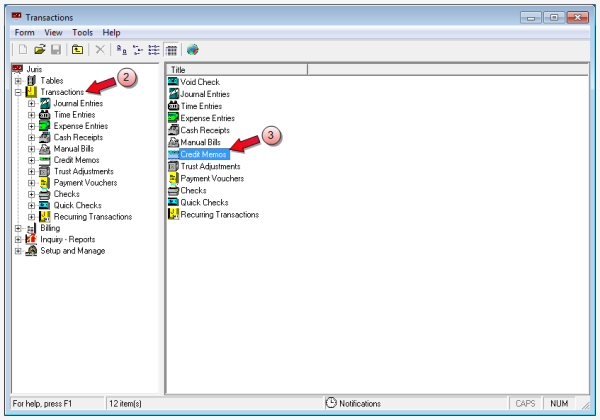

Start Juris and log in to open the main Juris window.

- Double-click Transactions to expand the folder.

-

Double-click Credit Memos to expand the folder.

-

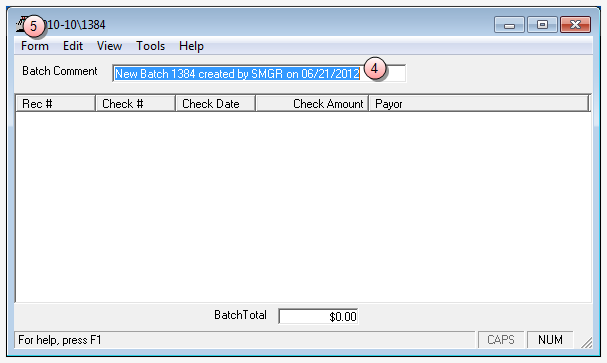

Select Form > New > Credit Memo on the menu to open the Batch window.

- In the Batch Comment box, type a name for this batch file, or use the default name.

-

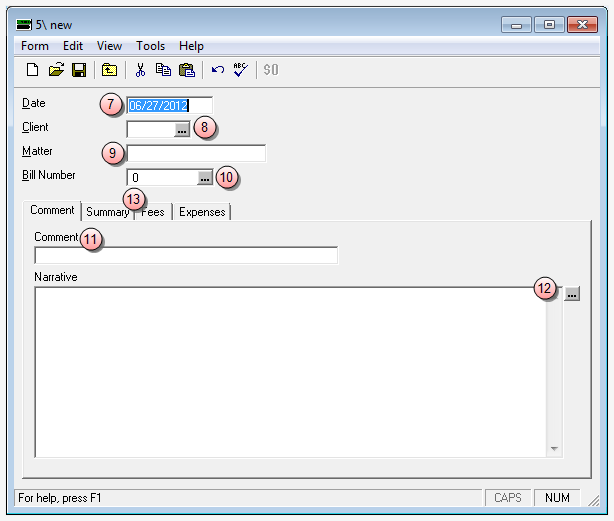

Select Form > New on the menu to open the Credit Memo window.

- In the Date box, type the date for this credit memo, or use the default (today's date.)

- In the Client box, type the client number, or click the ... (ellipses) button to search for, and select it. This is the client number to which the original credit memo was applied.

- In the Matter box, type the matter number to which the original credit memo was applied.

-

In the Bill Number box, type the bill number or click the ... (ellipses) button to search for, and select it in the Find tool. This is the bill number to which the original credit memo was applied.

NOTE: Bills that have a balance of zero do not show up in the Find tool.

- In the Comments box, type a short reason for the reversal of the credit memo.

- Optionally, in the Narrative box, click the ... (ellipses) button, and select a narrative.

-

Click the appropriate tab(s) and make your reverse allocations.

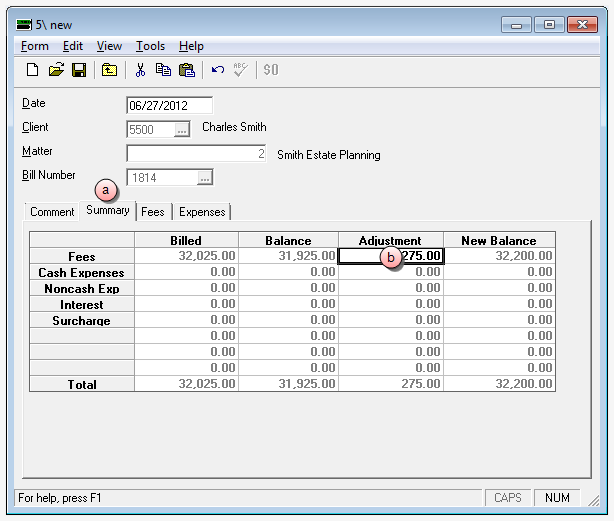

Make your adjustment(s) on the Summary tab to reverse a credit memo that had been applied in equal amounts across all outstanding bills.

Make your adjustment(s) on the Summary tab to reverse a credit memo that had been applied in equal amounts across all outstanding bills.

- Click the Summary tab.

- In the Adjustments column, type the same amount(s) that were entered on the original credit memo for all applicable charges (fees, cash expenses, noncash expenses, interest and surcharges.)

Make your adjustment(s) on the Fees tab to reverse a credit memo that had been applied to one or more outstanding bills, and in varying amounts.

Make your adjustment(s) on the Fees tab to reverse a credit memo that had been applied to one or more outstanding bills, and in varying amounts.

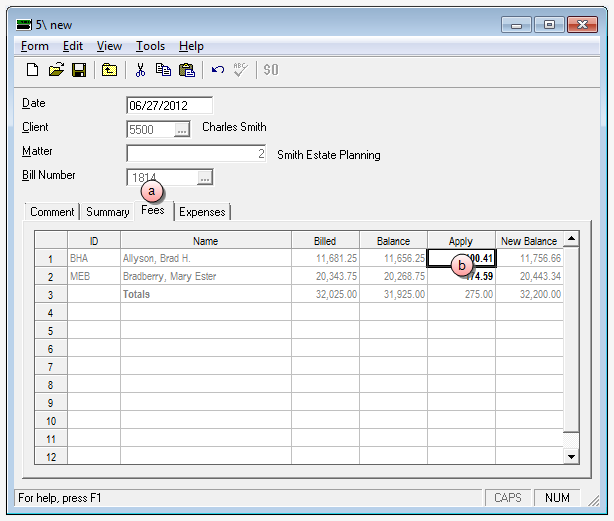

- Click the Fees tab.

- In the Apply column, type the same amount(s) that were entered on the original credit memo for all applicable fees.

Make your adjustment(s) on the Expenses tab to reverse a credit memo that had been applied to one or more billed expenses and in varying amounts.

Make your adjustment(s) on the Expenses tab to reverse a credit memo that had been applied to one or more billed expenses and in varying amounts.

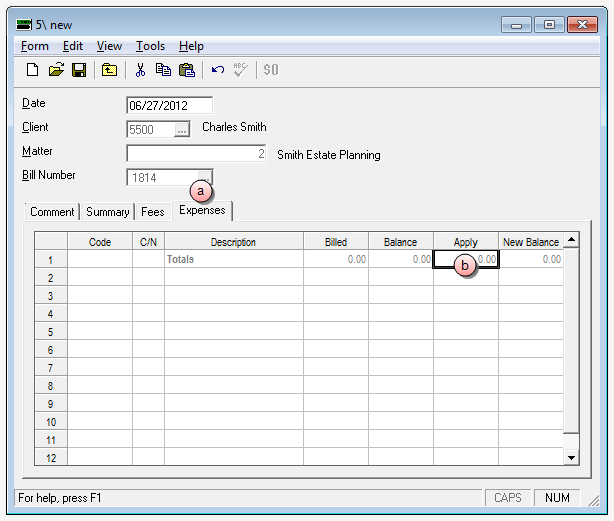

- Click the Expenses tab.

- In the Apply column, type the same amount(s) that were entered on the original credit memo for all applicable expenses.

- Verify the accuracy of the information you have entered.

- Select Form > Save on the menu to save the Credit Memo.

- Click the window Close button to close the Credit Memo window.

Warning: If you click Save, the program automatically posts the credit memo. It is recommended that you verify the information you have entered, prior to clicking Save.

What do I do if I have written off a bill and the client sent in a payment?

- Go to Client/Matter Inquiry and find the original bill number.

- Go back to Credit Memos and create a new one, entering the client/matter and bill number.

- On the new credit memo, reverse the credit memo by adding back (positive amount) what the client has paid.

Related information